How much is auto insurance in Massachusetts? That’s the burning question for anyone hitting the road in the Bay State. From the bustling streets of Boston to the quieter country roads, insurance costs vary wildly. This isn’t just about slapping down a payment; it’s about understanding the factors that inflate—or deflate—your premiums. We’re diving deep into the world of Massachusetts auto insurance, breaking down the costs, the coverage options, and the sneaky ways to save some serious dough.

This guide tackles everything from the impact of your driving record and car type to the importance of comparing quotes and understanding your state’s insurance laws. We’ll also explore the different types of coverage available, helping you navigate the often-confusing world of liability, collision, and comprehensive insurance. Get ready to become a Massachusetts auto insurance expert—and maybe even save a few bucks along the way.

Factors Affecting Auto Insurance Costs in Massachusetts

Source: forbes.com

Getting car insurance in Massachusetts can feel like navigating a maze, with premiums varying wildly depending on a number of factors. Understanding these factors can help you make informed decisions and potentially save money. Let’s break down the key elements that influence your auto insurance costs.

Driver Age and Insurance Premiums, How much is auto insurance in massachusetts

Younger drivers, typically those under 25, generally face higher insurance premiums in Massachusetts. This is because statistically, younger drivers are involved in more accidents than older, more experienced drivers. Insurance companies assess a higher risk, translating to higher premiums to offset potential payouts. As drivers gain experience and reach their mid-twenties and beyond, their premiums usually decrease significantly, reflecting a lower risk profile. For example, a 16-year-old driver might pay considerably more than a 35-year-old driver with a clean driving record, even if they drive the same car.

Driving History’s Impact on Rates

Your driving history is a major factor in determining your insurance rates. Accidents and traffic violations significantly increase your premiums. Each accident or ticket adds to your risk profile, indicating a higher likelihood of future incidents. The severity of the accident or the type of violation also plays a role. A DUI, for instance, will drastically increase your premiums compared to a minor speeding ticket. Maintaining a clean driving record is crucial for keeping your insurance costs low.

Comparison of Car Insurance Coverage Costs

Different types of car insurance coverage come with varying costs. Liability insurance, which is legally required in Massachusetts, covers damages you cause to others’ property or injuries you inflict on others. Collision coverage pays for repairs to your vehicle after an accident, regardless of fault. Comprehensive coverage protects against damage from events like theft, vandalism, or natural disasters. Liability is generally the cheapest, while collision and comprehensive add to the overall premium. Choosing the right coverage level depends on your individual needs and risk tolerance. For instance, a newer, more expensive car might warrant collision and comprehensive coverage, whereas an older car might only require liability.

Vehicle Type and Insurance Premiums

The type of vehicle you drive significantly impacts your insurance costs. Sports cars and luxury vehicles are generally more expensive to insure than sedans or smaller, more fuel-efficient cars. This is because these vehicles are often more expensive to repair and replace, and they may also be more likely to be involved in accidents due to their performance capabilities. The make, model, and year of your car all play a role in determining your premium. A new, high-performance car will typically cost significantly more to insure than a used, standard model.

Location in Massachusetts and Insurance Costs

Where you live in Massachusetts influences your insurance rates. Urban areas with higher accident rates and higher crime tend to have higher insurance premiums compared to rural areas. Insurance companies consider the risk associated with your location, factoring in things like traffic congestion, theft rates, and the frequency of accidents in your specific zip code. Living in a densely populated city like Boston will likely result in higher premiums than living in a smaller, more rural town.

Credit Score’s Influence on Insurance Rates

In Massachusetts, your credit score can impact your auto insurance premiums. Insurance companies use credit-based insurance scores to assess risk. A good credit score generally translates to lower premiums, while a poor credit score can result in higher premiums. This is based on the statistical correlation between credit history and insurance claims. It’s important to note that this practice is subject to regulations and varies by insurance company.

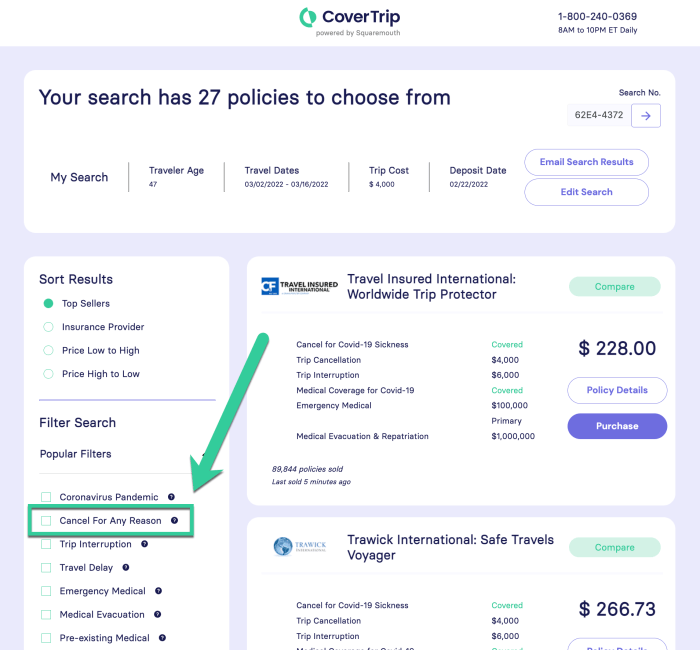

Obtaining Auto Insurance Quotes in Massachusetts

Navigating the world of auto insurance in Massachusetts can feel like driving through a blizzard – confusing and potentially costly. But armed with the right information, you can find the best coverage at a price that fits your budget. Getting quotes is the first, crucial step.

The process of obtaining auto insurance quotes involves contacting several insurance providers, providing them with your personal and vehicle information, and comparing their offers. This allows you to make an informed decision based on your specific needs and financial situation. Remember, not all insurance companies are created equal, and finding the right fit requires some legwork.

Figuring out how much auto insurance costs in Massachusetts can be a headache, especially when you’re juggling other business expenses. For construction companies, a major expense is securing the right coverage, which is why finding the best workers comp insurance for construction is crucial. Getting both right means you’re better prepared to handle unexpected costs, leaving you free to focus on your bottom line – and that sweet, sweet Massachusetts driving experience.

Comparing Auto Insurance Quotes Effectively

Effective comparison requires a systematic approach. Don’t just focus on the bottom line; consider the level of coverage, deductibles, and additional features offered. Start by creating a spreadsheet or using a comparison website to organize the information you gather. This allows for easy side-by-side comparisons of premiums and policy details. Consider factors like your driving history, the type of car you drive, and the coverage you need. For example, a driver with multiple accidents will likely pay a higher premium than a driver with a clean record.

Sample Auto Insurance Quotes Comparison

The following table presents hypothetical quotes from three major insurance providers in Massachusetts. Remember, these are examples only and actual quotes will vary based on individual circumstances.

| Insurance Company | Annual Premium | Deductible (Collision) | Additional Features |

|---|---|---|---|

| Company A | $1200 | $500 | Roadside assistance, rental car reimbursement |

| Company B | $1500 | $1000 | Accident forgiveness, uninsured/underinsured motorist coverage |

| Company C | $1100 | $500 | 24/7 customer service, online account management |

Understanding Policy Details Before Purchasing

Before committing to a policy, carefully review all the fine print. Understand the coverage limits, deductibles, exclusions, and any additional fees. Don’t hesitate to contact the insurance company directly to clarify anything you don’t understand. A seemingly small difference in coverage could have significant financial implications in the event of an accident. For instance, understanding the difference between liability-only and comprehensive coverage is vital.

Purchasing a Policy: Online vs. Agent

Purchasing a policy online offers convenience and speed. Many companies provide user-friendly websites where you can get quotes, compare options, and purchase coverage within minutes. However, working with an agent offers personalized guidance and support. An agent can help you understand complex policy details, negotiate better rates, and navigate the claims process. The best approach depends on your comfort level with technology and your preference for personal interaction. For example, someone comfortable with online tools might prefer the speed and ease of online purchasing, while someone who prefers a more hands-on approach might opt for an agent.

Types of Auto Insurance Coverage in Massachusetts

Navigating the world of auto insurance in Massachusetts can feel like driving through a Boston traffic jam – confusing and potentially costly. Understanding the different types of coverage is crucial to ensuring you’re adequately protected without overspending. This section breaks down the essential and optional coverages available, helping you make informed decisions about your policy.

Mandatory Auto Insurance Coverages in Massachusetts

Massachusetts is a no-fault state, meaning your own insurance company covers your medical bills and lost wages regardless of who caused the accident. However, this doesn’t absolve you from responsibility if you cause an accident. The state mandates specific minimum coverages to protect you and others. These include Personal Injury Protection (PIP) and Bodily Injury Liability. PIP covers medical expenses and lost wages for you and your passengers, while Bodily Injury Liability protects you if you injure someone else in an accident. The minimum required amounts for these coverages are subject to change, so it’s always best to check with the Massachusetts Division of Insurance for the most up-to-date information. Failure to carry the minimum required coverage can result in significant penalties.

Liability, Collision, Comprehensive, and Uninsured/Underinsured Motorist Coverage

These are the core types of coverage you’ll encounter when shopping for auto insurance. Understanding their differences is key to selecting the right policy for your needs.

- Liability Coverage: This covers damages you cause to other people or their property in an accident. It includes bodily injury liability (covering medical bills and lost wages of injured parties) and property damage liability (covering repairs to the other vehicle or property). Think of it as your protection against lawsuits if you’re at fault. For example, if you rear-end someone and cause $10,000 in damages to their car and $20,000 in medical bills, your liability coverage would pay for those costs (up to your policy limits).

- Collision Coverage: This covers damage to your vehicle regardless of who is at fault. If you hit a tree, another car, or even a deer, collision coverage will pay for the repairs or replacement of your vehicle, minus your deductible. This is optional, but highly recommended.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, fire, hail, or falling objects. Think of it as protection against everything *except* collisions. Like collision, it’s optional but valuable.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical bills, lost wages, and property damage even if the other driver doesn’t have enough insurance to cover your losses. This is crucial given the number of uninsured drivers on the road.

Optional Coverages: Roadside Assistance and Rental Reimbursement

While not mandatory, these add-ons can provide significant peace of mind and convenience.

- Roadside Assistance: This coverage provides help in case of breakdowns, flat tires, lockouts, or running out of gas. It can save you time, money, and a lot of frustration. Imagine being stranded on the side of the Mass Pike – roadside assistance would be a lifesaver.

- Rental Reimbursement: If your vehicle is damaged and needs repairs, this coverage helps pay for a rental car while yours is being fixed. This prevents the inconvenience of being without transportation during the repair process.

Benefits and Drawbacks of Each Coverage Type

Choosing the right coverage requires weighing the benefits against the costs. Here’s a summary:

| Coverage Type | Benefits | Drawbacks |

|---|---|---|

| Liability | Protects you from financial ruin if you cause an accident. | Doesn’t cover your own vehicle’s damage. |

| Collision | Covers damage to your vehicle regardless of fault. | Higher premiums than liability only. |

| Comprehensive | Covers non-collision damage to your vehicle. | Higher premiums than liability only. |

| UM/UIM | Protects you from uninsured/underinsured drivers. | Slightly higher premiums, but essential protection. |

| Roadside Assistance | Convenience and peace of mind in emergencies. | Adds to the overall premium cost. |

| Rental Reimbursement | Provides temporary transportation during repairs. | Adds to the overall premium cost. |

Saving Money on Auto Insurance in Massachusetts

Source: trustage.com

Navigating the world of auto insurance in Massachusetts can feel like driving through a blizzard – confusing and potentially expensive. But with a little savvy and planning, you can significantly reduce your premiums and keep more money in your wallet. This section Artikels practical strategies to lower your auto insurance costs.

Maintaining a Good Driving Record

A clean driving record is your best friend when it comes to affordable auto insurance. Insurance companies view drivers with a history of accidents and traffic violations as higher risks, leading to increased premiums. Conversely, a spotless record demonstrates responsible driving habits, resulting in lower rates. Even minor infractions can impact your premiums, so defensive driving is key. Consider the potential savings – a driver with a clean record might pay hundreds, even thousands, less annually than someone with multiple accidents or speeding tickets on their record. For example, a driver with three accidents in the past three years could see their premiums double or even triple compared to a driver with a perfect record.

Bundling Home and Auto Insurance

Many insurance companies offer discounts for bundling your home and auto insurance policies. This strategy leverages your loyalty and reduces administrative costs for the insurer, translating to savings for you. The discount percentage varies by company, but it can be substantial – often 10% or more. For instance, a homeowner who bundles their home and auto insurance with the same company could save an average of $500 annually, making this a simple yet effective way to reduce overall insurance expenses.

Increasing Your Deductible

Raising your deductible – the amount you pay out-of-pocket before your insurance coverage kicks in – is another way to lower your premiums. While this means a higher upfront cost in the event of an accident, the trade-off is often a significant reduction in your monthly or annual premiums. The amount of savings depends on the size of the increase, but a higher deductible generally translates to lower premiums. For example, increasing your deductible from $500 to $1000 could lead to a 15-20% reduction in your premium. This strategy requires careful consideration of your financial situation and risk tolerance.

Completing a Defensive Driving Course

Completing a state-approved defensive driving course can lead to premium reductions. These courses teach safe driving techniques and often result in a discount from your insurance provider as proof of your commitment to safe driving practices. The exact discount varies by insurer and the specific course completed, but it can range from 5% to 15% or more. It’s a relatively small investment of time that can yield significant long-term savings.

Shopping Around for the Best Rates

Don’t settle for the first quote you receive. Several online comparison tools and independent insurance agents can help you quickly and easily compare rates from multiple insurance providers. Take advantage of these resources to find the best deal for your specific needs and risk profile. Spend some time comparing quotes from at least three to five different companies. You might be surprised at the variation in prices and find significant savings by simply comparing offers. Remember to provide consistent information to each insurer for accurate comparisons.

Understanding Massachusetts Auto Insurance Laws

Navigating the world of auto insurance in Massachusetts requires understanding the state’s specific laws and regulations. This section clarifies the minimum insurance requirements, the claims process, penalties for driving uninsured, and the role of the state’s regulatory body. Understanding these aspects is crucial for responsible driving and financial protection.

Massachusetts mandates that all drivers carry a minimum level of liability insurance to protect themselves and others. Failure to comply can result in significant consequences.

Minimum Insurance Requirements

Massachusetts law requires drivers to maintain at least $20,000 in bodily injury liability coverage for one person injured in an accident, and $40,000 for multiple people injured in the same accident. Additionally, drivers must carry at least $5,000 in property damage liability coverage. These minimums are designed to compensate those injured or whose property is damaged in accidents caused by insured drivers. However, it’s important to note that these minimums may not be sufficient to cover significant damages, and many drivers opt for higher coverage limits for greater protection. Choosing higher limits is a personal decision, often influenced by financial circumstances and risk tolerance.

Filing an Auto Insurance Claim in Massachusetts

The process of filing an auto insurance claim in Massachusetts generally involves reporting the accident to your insurer as soon as possible. This usually involves providing details of the accident, including date, time, location, and the other party’s information. Your insurer will then guide you through the next steps, which may include completing an accident report form, providing supporting documentation (such as police reports and medical records), and cooperating with their investigation. The claim process can vary depending on the circumstances of the accident and the specific terms of your insurance policy. Complex claims may require the assistance of a lawyer or insurance professional.

Penalties for Driving Without Insurance

Driving without insurance in Massachusetts is a serious offense. Penalties can include significant fines, license suspension, and even vehicle impoundment. The exact penalties can vary depending on the circumstances and the number of offenses. Beyond the legal ramifications, driving without insurance leaves you financially vulnerable in the event of an accident. You could be held personally liable for significant damages, potentially leading to financial ruin.

Massachusetts Division of Insurance

The Massachusetts Division of Insurance (DOI) is the state agency responsible for regulating the insurance industry, including auto insurance. The DOI oversees insurance companies, ensures compliance with state laws, and investigates consumer complaints. The DOI’s website provides valuable resources for consumers, including information on insurance regulations, complaint procedures, and financial ratings of insurance companies. The DOI plays a crucial role in protecting consumers and maintaining a fair and competitive insurance market. Consumers can contact the DOI to report issues with their insurer or to seek clarification on insurance regulations.

Final Summary: How Much Is Auto Insurance In Massachusetts

Source: stantonins.com

So, how much *is* auto insurance in Massachusetts? The answer, as you’ve probably gathered, isn’t a simple number. It’s a complex equation shaped by your driving history, the type of car you drive, where you live, and even your credit score. But armed with the knowledge in this guide, you’re now equipped to navigate the system, compare quotes effectively, and find the best coverage at the most affordable price. Remember, understanding your options is the key to unlocking the best possible deal. Happy driving (and saving!)