Is John Hancock travel insurance good? That’s the million-dollar question for any traveler planning an adventure. We’re diving deep into the nitty-gritty of John Hancock’s travel insurance plans, dissecting coverage details, customer reviews, and comparing them to competitors. Prepare for a no-nonsense look at whether this insurance is worth your hard-earned cash before you book that flight.

From analyzing policy specifics and claim processes to uncovering real customer experiences and comparing John Hancock to its rivals, we’ll leave no stone unturned. We’ll explore the fine print, including exclusions and limitations, and even examine John Hancock’s financial stability to ensure your peace of mind. Get ready to make an informed decision about your travel insurance needs.

John Hancock Travel Insurance

Source: insider.com

John Hancock offers a range of travel insurance plans designed to protect travelers from unexpected events during their trips. Understanding the nuances of these plans is crucial for selecting the right coverage for your specific needs and travel style. This detailed breakdown will illuminate the various policy options and their respective coverage details.

Policy Coverage Details

John Hancock provides several travel insurance plans, each catering to different levels of coverage and traveler requirements. These plans typically include options for trip cancellation, medical emergencies, baggage loss, and other travel-related mishaps. However, the specific events covered and excluded vary depending on the chosen plan.

Types of John Hancock Travel Insurance Plans and Coverage Examples

While the exact plan names and details might change, John Hancock generally offers tiers of coverage, ranging from basic to comprehensive. A basic plan might cover trip cancellation due to specific, pre-defined reasons (like a sudden serious illness), while a comprehensive plan could extend coverage to a broader range of circumstances, including inclement weather impacting travel plans.

For instance, a basic plan might cover medical emergencies up to a certain limit, perhaps $50,000, while a premium plan could offer significantly higher coverage, potentially reaching $1 million or more. Similarly, baggage loss coverage will differ; a basic plan might only cover a limited amount for lost luggage, while a premium plan might offer more substantial reimbursement, and possibly cover more than just checked baggage. It’s important to note that pre-existing conditions often require separate supplemental coverage and are rarely fully covered by standard plans.

Comparison of Key Features Across John Hancock Plans

The following table offers a simplified comparison of hypothetical John Hancock travel insurance plans. Remember that actual plans and their specific features can vary. Always refer to the official John Hancock policy documents for the most up-to-date and accurate information.

| Plan Name | Coverage Amount (Medical) | Deductible Options | Pre-existing Condition Coverage |

|---|---|---|---|

| Basic | $50,000 | $0, $250, $500 | Limited or None |

| Standard | $100,000 | $0, $250, $500, $1000 | Optional supplemental coverage available |

| Premium | $250,000 | $0, $500, $1000 | More comprehensive optional supplemental coverage available |

| Comprehensive | $500,000 | $0, $1000 | May include some coverage, subject to policy terms and conditions |

Customer Reviews and Experiences

John Hancock Travel Insurance’s reputation, like any insurance provider, rests heavily on the experiences of its customers. Sifting through numerous online reviews provides a clearer picture of the company’s performance in handling claims, providing customer service, and delivering on its promises. While individual experiences can vary, identifying recurring themes in feedback helps paint a more comprehensive portrait.

Analyzing reviews from platforms like Trustpilot and Google Reviews reveals a mixed bag of experiences. While many customers praise specific aspects of the service, others express frustration with particular issues. Understanding these contrasting viewpoints is crucial for prospective travelers considering John Hancock’s travel insurance options.

Summary of Customer Feedback Themes

The following points summarize the most frequent themes emerging from customer reviews across various online platforms. It’s important to remember that these are generalizations based on aggregated feedback and individual experiences may differ significantly.

- Positive Feedback: Many customers highlight the ease of purchasing the policy and the clarity of the policy documentation. Several reviewers also praise the responsiveness of customer service representatives when dealing with straightforward inquiries. Some specifically mention positive experiences with relatively uncomplicated claim processes, receiving reimbursements without significant delays.

- Negative Feedback: A recurring complaint centers around the complexity of filing claims and the perceived lack of transparency in the claims process. Several reviewers describe lengthy processing times and difficulty reaching customer service representatives when dealing with complex or disputed claims. Frustration with unclear communication regarding claim denials is also a frequent complaint. Some reviewers mention difficulty navigating the website or finding necessary information.

Claim Processing Experiences

Claim processing appears to be a pivotal area where customer experiences diverge significantly. While some reviewers describe smooth and efficient claim settlements, others detail prolonged delays and frustrating interactions with the claims department. The complexity of the claim, the type of coverage, and the thoroughness of documentation provided by the customer seem to be significant factors influencing the overall experience.

- Positive experiences often involve straightforward claims, such as lost luggage or minor medical expenses, where the required documentation was readily available and complete.

- Negative experiences frequently involve more complex claims, such as those related to significant medical emergencies or trip cancellations due to unforeseen circumstances. In these cases, reviewers often report extended processing times, requests for additional documentation, and difficulty in understanding the reasons for delays or denials.

Customer Service Interactions

Customer service quality is another area where reviews reveal a considerable range of experiences. While some reviewers express satisfaction with the responsiveness and helpfulness of customer service representatives, others report difficulties in contacting representatives and receiving timely or adequate assistance. The method of contact (phone, email, online chat) may also influence the overall experience.

- Positive interactions often involve simple inquiries or straightforward claim updates, where representatives are described as knowledgeable, polite, and efficient.

- Negative interactions frequently involve complex claims or disputes, where reviewers report long wait times, unhelpful responses, and a lack of clear communication regarding the status of their claims.

Claim Process and Procedures

Source: pinnaclequote.com

Filing a travel insurance claim with John Hancock involves several steps, and understanding the process can significantly ease any stressful situation during unexpected travel disruptions. The speed and success of your claim depend largely on how thoroughly you follow these steps and the documentation you provide.

The process generally begins with notifying John Hancock as soon as reasonably possible after the incident requiring the claim. This notification usually involves contacting their claims department via phone or through their online portal. They will then guide you through the necessary steps and provide you with a claim form. Completing this form accurately and comprehensively is crucial for a smooth and timely resolution.

Required Documentation

Gathering the necessary documentation is a key step in the claim process. John Hancock typically requires original receipts, medical bills (if applicable), police reports (in cases of theft or accidents), and flight/hotel confirmation details showing changes or cancellations. Providing clear, legible copies of these documents is essential; blurry or incomplete documents can delay the process. It’s also advisable to keep a copy of all submitted documents for your records. Failure to provide sufficient documentation can lead to claim delays or denial.

Claim Processing Timeframe and Payment

The timeframe for claim processing varies depending on the complexity of the claim and the volume of claims John Hancock is handling. Simple claims, such as baggage delays with readily available documentation, might be processed within a few weeks. More complex claims, such as medical emergencies requiring extensive documentation from healthcare providers, could take several months. Payment is typically made via check or direct deposit, once the claim is fully processed and approved. John Hancock will communicate regularly with the claimant regarding the progress of their claim.

Examples of Approved and Denied Claims

Let’s consider a few scenarios. A claim for a lost passport, supported by a police report and passport application confirmation, would likely be approved, as it falls under the typical coverage of travel insurance. Conversely, a claim for a pre-existing medical condition that wasn’t disclosed during the policy application process would likely be denied, as most travel insurance policies exclude coverage for pre-existing conditions unless specifically addressed and additional premiums paid. Another example of a denied claim might be damage to personal property caused by negligence, unless specified coverage was purchased for such events. Finally, a claim for a trip cancellation due to a non-covered reason, such as a change of mind, would also be denied. John Hancock’s policy clearly Artikels covered and excluded events, and adherence to these guidelines is vital for claim approval.

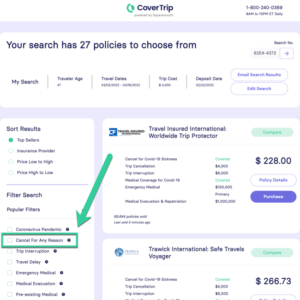

Comparison with Competitors: Is John Hancock Travel Insurance Good

Choosing the right travel insurance can feel like navigating a maze, especially with so many options available. John Hancock is a reputable name, but how does it stack up against other major players in the travel insurance market? This comparison will shed light on the key differences between John Hancock and its competitors, helping you make an informed decision.

To provide a clear picture, we’ll compare John Hancock with two significant competitors: Allianz Travel Insurance and Travel Guard. These companies offer a range of plans, so direct comparisons need to consider specific plan types with similar coverage levels. However, we can highlight general trends and key distinctions to aid your decision-making process.

Key Differences in Travel Insurance Plans

The following table summarizes key differences in pricing, coverage, and customer service ratings based on publicly available information and independent reviews. Remember that prices and specific coverage details can vary based on factors like trip length, destination, and age of travelers. Customer service ratings are averages based on multiple review platforms and should be considered a general indicator.

| Feature | John Hancock | Allianz Travel Insurance | Travel Guard |

|---|---|---|---|

| Price (Average for a standard 7-day trip) | $50 – $150 | $40 – $120 | $60 – $180 |

| Coverage (Typical inclusions) | Trip cancellation/interruption, medical expenses, baggage loss, emergency medical evacuation | Trip cancellation/interruption, medical expenses, baggage loss, emergency medical evacuation, 24/7 assistance | Trip cancellation/interruption, medical expenses, baggage loss, emergency medical evacuation, adventure sports coverage options |

| Customer Service Rating (Average from multiple sources) | 3.8 out of 5 stars | 4.2 out of 5 stars | 4.0 out of 5 stars |

Note: The pricing and ratings presented here are estimations based on aggregated data from various sources and are subject to change. Always check the specific plan details and pricing directly with the insurance provider.

Advantages and Disadvantages of Choosing John Hancock

Based on the comparison, choosing John Hancock offers certain advantages and disadvantages relative to its competitors.

Advantages: John Hancock’s strong reputation and established presence in the financial services industry can provide a sense of security for some travelers. Their plans often offer comprehensive coverage, including essential aspects like medical expenses and trip cancellation.

So, is John Hancock travel insurance good? It depends on your needs, but considering the breadth of coverage, it’s worth a look. However, before you travel, remember to check your existing policies – for example, did you know that does homeowners insurance cover tenants for their belongings? Understanding your existing coverage can save you money, ultimately influencing whether John Hancock’s travel insurance is the right fit for you.

Disadvantages: Compared to Allianz and Travel Guard, John Hancock might not always offer the most competitive pricing or the highest customer service ratings based on available reviews. Travel Guard, for example, frequently stands out for its robust adventure sports coverage, a significant advantage for adventurous travelers. Allianz consistently receives high praise for its 24/7 assistance services.

Policy Exclusions and Limitations

John Hancock travel insurance, like most travel insurance policies, doesn’t cover everything. Understanding the exclusions and limitations is crucial before you buy a policy, to avoid unpleasant surprises if something goes wrong during your trip. Knowing what’s *not* covered can be just as important as knowing what is.

Knowing the fine print is key to a smooth travel experience. Let’s delve into some specific areas where John Hancock’s coverage might not apply, helping you make an informed decision.

Pre-existing Medical Conditions

Pre-existing medical conditions often present a significant limitation in travel insurance policies. This means that if you have a health issue before purchasing the policy, John Hancock might not cover expenses related to that condition while traveling. For example, if you have a history of heart problems and experience a heart attack during your trip, your claim might be denied or partially covered, depending on the policy’s specific wording and how long ago the condition was diagnosed and treated. The definition of “pre-existing condition” can vary, so carefully review the policy’s definition and the waiting period before coverage begins. Some policies offer options to increase coverage for pre-existing conditions, often at an additional cost.

Activities Considered High-Risk

Many travel insurance policies exclude coverage for activities deemed inherently risky. John Hancock is no exception. This might include activities like bungee jumping, skydiving, or extreme sports. Even participating in less extreme, but still risky activities like mountain climbing or scuba diving without proper certification might lead to denied claims if an accident occurs. The policy will usually clearly define what constitutes a “high-risk” activity, so check the policy document before embarking on any adventurous pursuits. If you plan on participating in high-risk activities, you might need to consider specialized adventure travel insurance or add-on coverage.

Acts of Terrorism and War

Coverage for events like acts of terrorism or war is often explicitly excluded or limited in travel insurance policies. These are typically considered unpredictable and high-risk events, making them difficult to insure. John Hancock’s policies likely contain clauses addressing these situations. If your trip is disrupted or you suffer losses due to acts of terrorism or war, you might find your claim is not covered, unless you have purchased specific add-on coverage for such events.

Common Policy Limitations

It’s important to understand the common limitations that might affect your claim. These limitations can significantly impact the amount of reimbursement you receive.

- Coverage Limits: Policies have maximum payout amounts for various events. If your medical expenses exceed this limit, you’ll be responsible for the remaining cost.

- Deductibles: You’ll likely have to pay a deductible before coverage kicks in. This is a fixed amount you pay out-of-pocket before the insurance company starts covering expenses.

- Waiting Periods: Some coverage, such as for pre-existing conditions, might have a waiting period before it becomes effective.

- Exclusions for Certain Items: Specific items, like expensive jewelry or electronics, might have limited or no coverage unless you purchase additional coverage.

- Currency Fluctuations: Reimbursements might be subject to currency exchange rate fluctuations, potentially reducing the actual amount you receive.

Financial Strength and Stability of John Hancock

Source: cloudfront.net

John Hancock’s financial stability is a crucial factor when considering their travel insurance. A financially sound insurer is more likely to be able to pay out claims promptly and reliably, offering peace of mind to travelers. Understanding their financial health involves looking at their ratings and overall market standing.

John Hancock’s financial strength is consistently rated by independent agencies, providing a valuable benchmark for consumers. These ratings reflect the insurer’s ability to meet its obligations to policyholders, even during periods of economic uncertainty or high claim volumes. A strong rating indicates a lower risk of the company failing to pay out claims.

AM Best Rating and its Significance

AM Best is a leading credit rating agency specializing in the insurance industry. Their ratings assess the financial strength and creditworthiness of insurance companies globally. A high AM Best rating, such as A+ or A, signifies exceptional financial strength and a very low likelihood of default. A lower rating, conversely, indicates a higher level of risk. Checking John Hancock’s current AM Best rating on their website or through independent financial news sources offers a clear picture of their financial stability and its implications for travel insurance policyholders. This rating directly influences the reliability of their travel insurance offerings; a high rating suggests greater confidence in their ability to fulfill their obligations under the policy. For example, a consistently high AM Best rating would demonstrate John Hancock’s long-term financial health and commitment to meeting its policy obligations, reassuring potential customers.

Impact of Financial Strength on Claim Payments

The financial strength of John Hancock directly impacts their ability to pay travel insurance claims. A company with a robust financial position is better equipped to handle unexpected surges in claims, such as those resulting from widespread natural disasters or global pandemics. A strong financial standing ensures that policyholders are less likely to face delays or denials of legitimate claims. Conversely, a weaker financial position could lead to difficulties in processing claims or even the inability to pay out large sums. For instance, a company with a low rating might struggle to pay out claims during a major event, causing significant financial hardship for affected travelers. John Hancock’s consistent financial strength therefore provides a level of assurance that claims will be handled efficiently and fairly.

Illustrative Scenarios

Understanding how John Hancock Travel Insurance might respond to real-world travel disruptions is key to assessing its value. Let’s examine three common scenarios and how their coverage might play out. Remember, specific policy details and coverage levels vary depending on the plan purchased. Always refer to your policy documents for precise information.

Trip Cancellation Due to Unexpected Illness

Imagine Sarah, a meticulous planner, booked a dream vacation to Italy costing $5,000. A week before departure, she falls seriously ill and her doctor advises against air travel. Sarah purchased John Hancock’s “Comprehensive” travel insurance plan, which includes trip cancellation coverage. Assuming her illness meets the policy’s definition of a covered reason (and providing appropriate medical documentation), John Hancock would likely reimburse Sarah for her prepaid, non-refundable trip expenses. The policy likely has a deductible, perhaps $250, so Sarah would receive approximately $4,750 (after the deductible). However, if her illness was a pre-existing condition not properly disclosed during the application process, the claim could be denied, partially or completely, as per the policy’s exclusions.

Medical Emergency During the Trip, Is john hancock travel insurance good

During a backpacking trip through Southeast Asia, Mark suffers a severe ankle injury requiring emergency surgery and hospitalization. His “Explorer” plan from John Hancock includes medical expense coverage up to a specified limit, say $50,000. The surgery and subsequent medical care cost $30,000. John Hancock would cover the majority of these costs, potentially requiring Mark to meet a deductible (e.g., $500) and possibly co-insurance. After submitting necessary medical bills and documentation, Mark could expect reimbursement for the bulk of his medical expenses, potentially around $29,500. However, if Mark engaged in activities specifically excluded in his policy (like extreme sports not covered by the “Explorer” plan), a portion or all of the claim might be denied.

Lost Luggage on an International Flight

Lisa’s checked luggage goes missing on her flight to London with John Hancock’s “Standard” plan. Her policy includes baggage delay and loss coverage. After reporting the lost luggage to the airline and providing documentation to John Hancock, the insurer might reimburse her for essential items purchased to replace toiletries and clothing while awaiting the luggage. The reimbursement amount would be capped, likely to a few hundred dollars, and might require receipts as proof of purchase. If her luggage is never found, she might receive a further payment to cover the cost of replacing her lost belongings, again up to a pre-defined limit specified in her policy. The amount reimbursed would depend on the declared value of her luggage at the time of purchasing the insurance, and any deductible applied. If Lisa failed to report the lost luggage within the stipulated timeframe Artikeld in her policy, the claim could be affected.

Conclusive Thoughts

So, is John Hancock travel insurance a good fit for you? The answer, as with most things in life, is: it depends. Weigh the pros and cons based on your specific travel needs and risk tolerance. While John Hancock offers comprehensive coverage and a strong financial backing, it’s crucial to carefully review the policy details, compare it to other options, and consider your personal travel style before making a decision. Don’t let unforeseen circumstances ruin your trip – choose wisely!