John Hancock Annual Travel Insurance: ditch the travel anxiety and embrace the adventure! This comprehensive guide dives deep into the various plans, highlighting their perks and pitfalls. We’ll unpack the coverage details, compare prices against competitors, and even walk you through the claims process. Get ready to navigate the world of travel insurance with confidence.

From emergency medical evacuations to lost luggage woes, we’ll explore how John Hancock’s policies can provide a safety net for your next trip. We’ll cover everything from understanding the different plan tiers and their respective benefits to identifying potential exclusions and limitations. Think of this as your ultimate cheat sheet for making the most informed decision about your travel insurance needs.

Understanding John Hancock Annual Travel Insurance Plans

John Hancock offers annual travel insurance, a smart choice for frequent travelers. Unlike single-trip policies, an annual plan provides year-round coverage, offering peace of mind for those who jet-set regularly or live a nomadic lifestyle. Understanding the different levels of coverage is key to choosing the right plan for your needs and budget.

John Hancock’s annual travel insurance plans are designed to cater to various travel styles and risk tolerances. They typically offer different tiers of coverage, each with increasing levels of benefits and premiums. The specific details of each plan can vary, so it’s crucial to carefully review the policy documents before purchasing.

John Hancock Annual Travel Insurance Plan Tiers

While the exact names and details of John Hancock’s plan tiers might change, they generally follow a tiered structure. Think of it like this: a basic plan, a mid-range plan, and a comprehensive plan. Each offers a different level of protection, from essential coverage to more extensive benefits. The higher the tier, the greater the coverage and, naturally, the higher the premium.

Benefits Included in Each Plan Tier

The benefits included in each plan tier will vary. However, common benefits across most plans typically include emergency medical expenses, trip cancellation or interruption coverage, and baggage loss or delay protection. Higher tiers often add features like emergency medical evacuation, 24/7 assistance services, and coverage for activities like adventure sports (subject to limitations and additional premiums).

For example, a basic plan might offer a limited amount of medical expense coverage, perhaps up to $50,000, with lower limits for trip cancellation and baggage loss. A higher tier might offer $1 million or more in medical expense coverage, plus higher limits for other benefits and broader coverage for unforeseen circumstances.

Comparison with Other Leading Providers

Comparing John Hancock’s annual travel insurance with other leading providers requires careful consideration of several factors. Key aspects to compare include the overall cost, the extent of coverage for various events (medical emergencies, trip cancellations, lost luggage), the level of customer service, and the claims process. Some providers might offer specialized coverage for specific activities or demographics, which John Hancock might not. Others may have a more streamlined claims process or better customer reviews.

For instance, while John Hancock might offer competitive pricing on its basic plan, a competitor might excel in offering comprehensive coverage for adventure travel. It’s recommended to compare policy documents directly from multiple providers to identify the best fit for your individual travel needs and risk profile. Don’t just focus on price; examine the breadth and depth of the coverage offered.

Policy Features and Exclusions

John Hancock Annual Travel Insurance offers a comprehensive package, but understanding its features and limitations is crucial before you jet off. Knowing what’s covered and what’s not can save you from unexpected financial burdens during your travels. This section breaks down the key aspects of the policy, highlighting both its strengths and its restrictions.

The policy aims to provide peace of mind during your travels, offering crucial support in unforeseen circumstances. However, like most insurance policies, it has specific exclusions and limitations that need careful consideration.

John Hancock’s annual travel insurance offers solid coverage, but finding the right plan can feel like navigating a maze. For a broader perspective on insurance options, check out what maryville insurance has to offer; comparing different providers helps you secure the best travel protection. Ultimately, the best annual travel insurance depends on your individual needs, so make sure to carefully consider your options before selecting John Hancock or any other provider.

Emergency Medical Evacuation and Repatriation of Remains

Emergency medical evacuation covers the costs associated with transporting you to the nearest appropriate medical facility in case of a serious illness or injury while traveling abroad. This often involves specialized medical flights or ground transportation. Repatriation of remains, sadly, covers the costs of returning your body to your home country in the event of death while traveling. These provisions are vital for ensuring you receive necessary medical attention or that your family is not burdened with significant expenses in a time of grief. For example, if you suffer a severe heart attack in a remote location, the policy could cover the cost of a medevac flight to a hospital with better facilities. Similarly, if a covered traveler were to pass away overseas, the insurance would assist with the complex logistics and costs associated with returning their remains.

24/7 Assistance Services

John Hancock provides 24/7 assistance services accessible via phone. This invaluable resource can help with everything from finding a local doctor to arranging emergency travel arrangements, providing translation services, and offering support during challenging situations. This constant access to support offers reassurance, particularly when dealing with unfamiliar environments or language barriers. Imagine needing to find an English-speaking doctor in a foreign country at 3 AM; the 24/7 assistance line can be your lifeline in such situations.

Exclusions and Limitations of Coverage

It’s important to understand that certain situations are excluded from coverage. Pre-existing conditions, for instance, may not be fully covered unless specifically addressed and approved prior to policy activation. This requires disclosure during the application process. Additionally, participation in high-risk activities such as extreme sports (e.g., bungee jumping, skydiving) often falls outside the scope of standard coverage, requiring additional riders or may be completely excluded. Finally, certain geographical areas experiencing political instability or declared unsafe by the insurer may have restricted or no coverage. For example, travel to a war-torn region would likely be excluded from coverage. Carefully reviewing the policy documents to understand the specifics of these exclusions is crucial before purchasing the plan.

Examples of Denied or Limited Coverage

Let’s say you have a pre-existing heart condition and suffer a heart attack while traveling. If you didn’t disclose this condition before purchasing the policy, your claim for medical expenses could be denied or significantly limited. Similarly, if you participate in an unsanctioned mountain climbing expedition and suffer an injury, your claim might be denied because the activity is considered high-risk and outside the policy’s coverage. Or, if you travel to a region under a travel advisory and experience an emergency, your coverage might be limited or denied depending on the specific terms of your policy. It is vital to read the fine print and understand the specific limitations related to pre-existing conditions, adventurous activities, and geographical restrictions.

Pricing and Value for Money

Source: errorexpress.com

Choosing the right annual travel insurance plan often boils down to finding the sweet spot between comprehensive coverage and affordable pricing. John Hancock offers various plans, and understanding how their pricing works is crucial for making an informed decision. Several key factors influence the final cost, and comparing them to competitors helps determine if the value proposition is right for you.

Factors Determining John Hancock Annual Travel Insurance Costs

The cost of your John Hancock annual travel insurance policy is influenced by a number of interconnected factors. Primarily, your age plays a significant role, with older travelers generally paying higher premiums due to increased risk. The destination you plan to visit is another major factor; travel to high-risk regions naturally commands higher premiums due to the potential for medical emergencies or political instability. Finally, the level of coverage you select significantly impacts the price. A plan with higher limits for medical expenses, emergency evacuation, and trip cancellation will inevitably cost more than a basic plan.

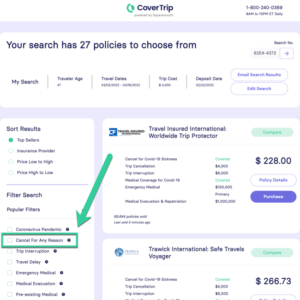

Price Comparison with Competitors

Directly comparing John Hancock’s annual travel insurance plans to competitors requires specifying the exact coverage levels and destinations. However, a general observation is that John Hancock tends to be competitively priced within the market for comparable coverage. Many online comparison tools allow you to input your specific needs and preferences to receive customized quotes from multiple providers, including John Hancock, facilitating a side-by-side comparison. Remember to always focus on the overall value offered, considering both price and the comprehensiveness of the coverage.

Sample John Hancock Annual Travel Insurance Plan Comparison

The following table illustrates the price variation between three hypothetical John Hancock annual travel insurance plans with differing coverage levels. Note that these are illustrative examples and actual prices may vary based on the factors mentioned earlier. Always obtain a personalized quote from John Hancock or a comparison website for the most accurate pricing information.

| Plan Name | Annual Premium (Example) | Medical Expense Coverage | Trip Cancellation Coverage |

|---|---|---|---|

| Basic Traveler | $250 | $50,000 | $2,000 |

| Comprehensive Traveler | $400 | $100,000 | $5,000 |

| Elite Traveler | $600 | $250,000 | $10,000 |

Claim Process and Customer Support

Navigating the unexpected is never fun, especially when it involves travel mishaps. Understanding John Hancock’s claim process and the support available can significantly ease the burden during stressful situations. Knowing what to expect can make all the difference in a smooth and efficient resolution.

Filing a claim with John Hancock typically involves several straightforward steps. First, you’ll need to gather all necessary documentation related to your incident, such as medical bills, police reports (if applicable), and receipts for any expenses incurred. Next, you’ll submit your claim through their designated channels, which we’ll detail below. After submission, John Hancock will review your claim and supporting documents. They’ll then contact you to request any additional information if needed, and finally, process your claim for reimbursement. The entire process is designed to be as streamlined as possible.

Claim Filing Procedure

The claim process is designed for ease of use. Upon experiencing a covered event, you should promptly notify John Hancock. This typically involves contacting their customer service department via phone or online portal. They will provide you with a claim form and a detailed list of the necessary documentation. Accurate and complete documentation significantly speeds up the process. Once the completed form and all supporting documentation are submitted, John Hancock will review the claim and, if approved, will process the reimbursement. Remember to keep copies of all submitted documents for your records.

Customer Testimonials

While specific customer testimonials are not publicly available in a consistently compiled format, general feedback often highlights the responsiveness and helpfulness of John Hancock’s customer support team. Many positive reviews mention clear communication throughout the claims process, efficient processing times, and a fair assessment of claims. However, as with any insurance provider, individual experiences can vary. It’s crucial to carefully review the policy details and understand the specific coverage before purchasing the plan.

Customer Support Options, John hancock annual travel insurance

John Hancock offers multiple avenues for customer support. They provide a dedicated phone number for immediate assistance, allowing policyholders to speak directly with a representative. Email support is also available, offering a convenient alternative for less urgent inquiries. Additionally, their website often contains a comprehensive FAQ section and online resources that address common questions and concerns regarding the policy and the claims process. This multi-faceted approach aims to ensure that policyholders can easily access the support they need, regardless of their preferred communication method.

Suitability for Different Traveler Profiles: John Hancock Annual Travel Insurance

Source: tiffininsurance.com

John Hancock annual travel insurance isn’t a one-size-fits-all solution. Its effectiveness depends heavily on the individual traveler’s needs and travel patterns. Understanding your travel style is key to determining if an annual plan offers the best value compared to single-trip policies. Let’s explore how different traveler profiles might find John Hancock’s offerings particularly beneficial.

Choosing the right John Hancock annual travel insurance plan hinges on your travel frequency, destination types, and specific needs. Factors such as age, health conditions, and the nature of your travels all play a significant role in determining suitability. The plans are designed with flexibility in mind, but aligning your needs with the plan’s coverage is paramount for maximizing its value.

Frequent Travelers

Frequent travelers, those who embark on multiple trips annually, often find annual travel insurance plans more cost-effective than purchasing single-trip policies each time. The predictability of expenses and the convenience of having continuous coverage make it an attractive option. John Hancock’s annual plans offer this consistent protection, eliminating the hassle of repeatedly buying insurance.

- Best Plan Type: A comprehensive annual plan offering high coverage limits for medical expenses and trip cancellations, potentially including options for baggage loss and emergency medical evacuation.

Families

Families traveling together often require broader coverage to accommodate the needs of multiple individuals. Children, in particular, might require specialized medical attention, potentially resulting in higher expenses. An annual plan can provide this comprehensive protection for the entire family throughout the year, simplifying the insurance process and ensuring everyone is covered.

- Best Plan Type: A family plan with sufficient coverage limits for each family member, including provisions for child-specific medical needs and trip interruption benefits.

Seniors

Seniors, often considered a higher-risk group by insurers, may face challenges finding affordable travel insurance. Pre-existing conditions can further complicate the process. However, John Hancock offers plans designed to cater to the specific needs of older travelers, often with options to include coverage for pre-existing conditions (subject to underwriting).

- Best Plan Type: A plan specifically designed for seniors, offering broader medical coverage and addressing potential health concerns, with clear terms regarding pre-existing conditions.

Adventure Travelers

Adventure travelers often engage in activities considered high-risk, such as extreme sports or trekking in remote locations. Standard travel insurance policies may not cover these activities, or may require additional premiums. John Hancock’s offerings might provide options to include adventure sports coverage (with appropriate add-ons), ensuring protection during potentially risky ventures.

- Best Plan Type: A plan that allows for add-ons to cover adventure sports and activities, with clearly defined limits and exclusions related to high-risk pursuits. Careful review of the policy wording regarding specific activities is essential.

Illustrative Scenarios and Coverage

Source: foolcdn.com

Let’s get real about travel mishaps – they happen. But with the right insurance, you can breathe easier knowing you’re covered. Here are three common travel scenarios and how John Hancock Annual Travel Insurance might respond. Remember, specific coverage depends on your chosen plan, so always refer to your policy documents.

Medical Emergency Abroad

Imagine this: You’re backpacking through Southeast Asia, enjoying the vibrant culture, when suddenly you fall ill and require emergency medical evacuation. John Hancock Annual Travel Insurance could cover a significant portion of your medical expenses, including hospitalization, doctor visits, and even the cost of transporting you back home for further treatment, depending on your plan’s limits and the specific circumstances. The policy might also cover emergency medical evacuation via air ambulance, a crucial expense in remote areas. To file a claim, you’ll need to gather all medical bills, receipts for transportation, and a detailed report from your attending physician. You’ll then submit these documents, along with a completed claim form, to John Hancock. The processing time will vary, but you’ll likely need to provide ongoing updates throughout your treatment.

Trip Cancellation Due to Severe Weather

Picture this: You’re about to embark on a long-awaited ski trip to the Alps, but a blizzard hits, rendering your flight cancelled and your resort inaccessible. If your trip cancellation is due to unforeseen and severe weather conditions, John Hancock’s annual travel insurance could reimburse you for non-refundable trip costs, such as flights, accommodation, and pre-paid activities. The level of reimbursement depends on your policy and the specific terms of your trip arrangements. To file a claim, you’ll need to provide official documentation from the airline or relevant transportation provider confirming the cancellation due to weather, along with proof of your non-refundable expenses (e.g., flight tickets, hotel bookings).

Lost Luggage

Let’s say you’re on a business trip to New York City, and your checked luggage goes missing during transit. John Hancock’s annual travel insurance may offer coverage for the replacement cost of essential items lost in your luggage. This typically includes clothing, toiletries, and other personal necessities. However, it’s important to note that there are usually limits on the amount reimbursed for lost luggage, and the policy might require you to file a lost luggage report with the airline and provide supporting documentation, such as baggage claim tags and receipts for any necessary replacements. You’ll likely need to submit photos of the lost luggage and a detailed list of the missing items and their estimated value.

Terms and Conditions

Navigating the fine print of any insurance policy can feel like decoding hieroglyphics, but understanding the terms and conditions of your John Hancock annual travel insurance is crucial for a smooth trip. These terms dictate what’s covered, what’s not, and what could land you in hot water (or, you know, without coverage). Essentially, it’s the contract between you and the insurer, outlining your rights and responsibilities.

Knowing the implications of violating these terms can save you a significant headache – and potentially a lot of money. A seemingly small oversight can lead to a denied claim, leaving you stuck with unexpected medical bills or travel expenses.

Policy Violation Implications

Violating the terms and conditions of your John Hancock annual travel insurance policy can result in your claim being denied, partially denied, or even lead to the termination of your policy. The severity of the consequences depends on the nature and extent of the violation. For instance, failing to disclose a pre-existing medical condition that later requires treatment during your travels could lead to a complete denial of your claim for related medical expenses. Similarly, engaging in activities explicitly excluded in the policy, such as extreme sports without supplemental coverage, could result in the same outcome. The insurer has the right to investigate any claim and determine if policy terms were adhered to.

Examples of Common Policy Violations

Understanding common violations can help you avoid them. Here are a few examples:

- Failure to disclose pre-existing conditions: Let’s say you have a history of heart problems and fail to mention it during the application process. If you experience a heart-related issue while traveling, your claim for medical treatment might be rejected. The insurer may argue that had they known about your pre-existing condition, they would have either excluded it from coverage or charged a higher premium.

- Engaging in prohibited activities: Many policies exclude coverage for activities like bungee jumping, scuba diving, or mountain climbing without specific add-on coverage. Participating in these activities without proper supplemental insurance and then needing medical attention could lead to a denied claim. Imagine breaking your leg while paragliding – a hefty medical bill without coverage.

- Failing to report a loss promptly: Let’s say your luggage is lost. Most policies require you to report the loss within a specific timeframe (often 24-48 hours). Delaying the report could jeopardize your claim for reimbursement of lost belongings. The insurer may argue that a timely report could have facilitated faster recovery of your luggage.

- Providing inaccurate information: Submitting false or misleading information on your application, such as exaggerating the value of your belongings or providing incorrect details about your trip itinerary, could lead to a claim denial. This is a serious breach of contract and could have legal ramifications beyond the insurance claim itself.

Outcome Summary

So, is John Hancock Annual Travel Insurance right for you? Ultimately, the best policy depends on your individual travel style and risk tolerance. By carefully weighing the coverage levels, pricing, and customer support, you can choose a plan that provides peace of mind without breaking the bank. Remember, a little preparation goes a long way in ensuring a smooth and worry-free travel experience. Bon voyage!