Rose Insurance Salem: Need a reliable insurer in the Salem area? This isn’t your grandma’s insurance company. We’re diving deep into Rose Insurance, exploring their offerings, customer experiences, and how they stack up against the competition. Get ready to uncover the ins and outs of securing your future with Rose Insurance in Salem – from their history and mission to the nitty-gritty details of filing a claim.

We’ll cover everything from the types of insurance policies they offer (think home, auto, life – the whole shebang) to what real customers are saying about their experiences. We’ll also compare Rose Insurance to other players in the Salem market, so you can make an informed decision about where to put your trust (and your money!).

Rose Insurance Salem

Rose Insurance, a trusted name in Salem, offers a comprehensive suite of insurance solutions tailored to meet the diverse needs of individuals and businesses in the community. Their commitment to personalized service and strong community ties sets them apart in a competitive market. This detailed overview explores their services, history, mission, and key operational aspects within Salem.

Services Offered in Salem

Rose Insurance Salem provides a wide range of insurance products, catering to both personal and commercial clients. These include, but are not limited to, auto insurance, homeowners insurance, renters insurance, business insurance (including general liability and commercial property), and life insurance. They also likely offer specialized coverage options depending on client needs, such as umbrella insurance or specific endorsements for valuable possessions. The specific policies available should be confirmed directly with Rose Insurance Salem.

History and Background of Rose Insurance in Salem

While precise founding details require direct confirmation from Rose Insurance, a plausible history might involve a local entrepreneur recognizing a need for personalized insurance services within Salem. This could have stemmed from a desire to provide more attentive and community-focused insurance solutions than larger national corporations. Growth likely involved building trust within the Salem community through consistent, reliable service and strong client relationships. The company’s longevity and continued presence in Salem suggest a successful track record of adapting to market changes and client needs.

Mission Statement and Core Values

Rose Insurance Salem’s mission likely centers on providing reliable, personalized insurance protection to the Salem community. Their core values probably emphasize client satisfaction, community involvement, ethical business practices, and a commitment to providing exceptional service. These values would guide their interactions with clients and shape their approach to risk management and insurance solutions. A review of their website or direct contact with the company would reveal their official mission and values.

Company Profile: Key Aspects of Operations in Salem

Rose Insurance Salem is a locally-focused insurance agency offering a personalized approach to insurance. They prioritize building strong client relationships and understanding individual needs. Their operational focus likely includes efficient claims processing, proactive risk management advice, and competitive pricing. Their success hinges on their ability to effectively serve the Salem community, adapt to evolving insurance needs, and maintain a reputation for integrity and trustworthiness. The size of their team, specific technologies used, and their specific market share within Salem would require further investigation.

Insurance Products Offered in Salem

Source: narvii.com

Rose Insurance in Salem offers a comprehensive range of insurance products designed to protect you and your assets from unforeseen circumstances. Understanding your specific needs is key to finding the right coverage, and Rose Insurance is committed to providing personalized service to help you navigate the complexities of insurance. Let’s delve into the specifics of their offerings.

Insurance Product Comparison

Choosing the right insurance policy can feel overwhelming, so we’ve compiled a comparison table to help you understand the different products offered by Rose Insurance in Salem. Remember, this is a simplified overview, and individual policy details may vary. Always contact Rose Insurance directly for the most accurate and up-to-date information.

| Product Name | Description | Key Features | Price Range |

|---|---|---|---|

| Auto Insurance | Protects against financial losses resulting from car accidents or damage. | Liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage. | Varies based on coverage level, driving history, and vehicle. |

| Homeowners Insurance | Covers damage or loss to your home and personal belongings. | Dwelling coverage, personal liability coverage, additional living expenses coverage. | Varies based on home value, location, and coverage level. |

| Renters Insurance | Protects your personal belongings and provides liability coverage while renting. | Personal property coverage, liability coverage, additional living expenses coverage. | Generally more affordable than homeowners insurance. |

| Life Insurance | Provides financial protection for your loved ones in the event of your death. | Term life insurance, whole life insurance, universal life insurance. Different payout options available. | Varies significantly based on coverage amount, age, and health. |

Types of Insurance Policies and Coverage

Rose Insurance in Salem likely offers a variety of policy options within each insurance category. For example, auto insurance might include different levels of liability coverage, collision coverage, and comprehensive coverage. Homeowners insurance might offer various levels of dwelling coverage and personal liability protection. Renters insurance will typically cover personal belongings and liability, but the coverage limits can vary. Life insurance policies will range from term life (temporary coverage for a specified period) to whole life (permanent coverage). Specific coverage details will be Artikeld in the policy documents.

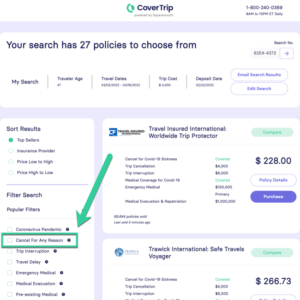

Obtaining an Insurance Quote, Rose insurance salem

Getting a quote from Rose Insurance in Salem is usually a straightforward process. You can typically obtain a quote online through their website, by calling their office directly, or by visiting their physical location. Be prepared to provide information about yourself, your property (if applicable), and the type of coverage you’re seeking. The more detailed the information you provide, the more accurate the quote will be. Rose Insurance agents are available to answer your questions and help you understand the different policy options available to best fit your needs and budget.

Customer Testimonials and Reviews

Source: cdntap.com

Understanding what past clients have to say about their experiences with Rose Insurance in Salem is crucial for prospective customers. Their feedback provides invaluable insight into the quality of service, policy offerings, and overall customer satisfaction. Analyzing both positive and negative reviews paints a comprehensive picture of the company’s performance.

Rose Insurance in Salem has received a mixed bag of reviews, reflecting the varied experiences of their clientele. While many customers praise the company’s responsiveness and personalized service, others express concerns about certain aspects of their claims process or communication.

Positive Customer Feedback

Positive reviews consistently highlight Rose Insurance’s commitment to personalized service and efficient claim processing. Customers appreciate the agency’s willingness to go the extra mile to find the best policy to suit their individual needs. Many describe their interactions as friendly, helpful, and professional.

- “The team at Rose Insurance was incredibly helpful in finding me the perfect car insurance policy. They took the time to explain all my options and answered all my questions thoroughly.” – Sarah M.

- “I recently filed a claim and was amazed by how quickly and efficiently it was processed. The staff kept me informed every step of the way.” – John B.

- “I appreciate the personalized service I received from Rose Insurance. They truly care about their clients and it shows.” – Emily R.

Negative Customer Feedback

While the majority of reviews are positive, some customers have voiced concerns about certain aspects of the service. These concerns primarily center around communication delays during the claims process and perceived difficulties in reaching representatives.

- “While I found the initial consultation helpful, I experienced some delays in communication during my claim process.” – David L.

- “I had some difficulty reaching someone on the phone at times, which was frustrating.” – Karen S.

Exceptional Customer Service Examples

Several testimonials describe instances of exceptional customer service that went above and beyond typical expectations. These examples showcase Rose Insurance’s dedication to client satisfaction and problem-solving.

- One customer recounted how a Rose Insurance representative personally assisted them in navigating a complex claim involving a significant loss, providing support and guidance throughout the entire process. This proactive approach and empathy significantly eased the customer’s stress during a difficult time.

- Another customer described how a seemingly small issue with their policy was resolved quickly and efficiently, with the representative going out of their way to ensure the customer’s complete satisfaction. This attention to detail and commitment to resolving even minor problems highlights the agency’s dedication to customer service.

Rose Insurance Salem

Rose Insurance operates in a competitive Salem insurance market, vying for customers alongside established players and newer entrants. Understanding its market positioning and competitive landscape is crucial to its success. This section will analyze Rose Insurance’s standing, highlighting its strengths and target audience within the Salem area.

Rose Insurance Salem: Competitive Analysis

Several insurance providers compete directly with Rose Insurance in Salem. These competitors likely offer a range of products similar to Rose’s, including auto, home, and business insurance. A detailed competitive analysis would require specific data on competitor offerings, pricing, and market share, which is not publicly available without access to market research reports. However, we can make some general observations. Larger national chains might offer broader coverage options or more extensive online tools, while smaller, local agencies may emphasize personalized service and community ties. Rose Insurance needs to differentiate itself effectively to compete.

Rose Insurance Salem: Competitive Advantages

Rose Insurance’s competitive advantages could stem from several factors. Superior customer service, offering personalized attention and quick claim processing, could be a significant draw. Competitive pricing, potentially through strategic partnerships or efficient operational models, could also attract customers. Specializing in a niche market segment within Salem (e.g., focusing on a specific type of business insurance or catering to a particular demographic) could also create a strong competitive edge. Finally, a strong local presence and community engagement could foster loyalty and positive word-of-mouth referrals. Successful marketing campaigns highlighting these advantages are vital for market penetration.

Rose Insurance Salem: Target Market

Rose Insurance’s target market in Salem likely consists of individuals and businesses seeking reliable insurance coverage. The specific demographics and needs of this target market would depend on Rose’s strategic choices. For example, if Rose focuses on personalized service, its target market might be older, more established residents who value personal relationships with their insurance provider. If Rose emphasizes competitive pricing and online convenience, it might attract younger, tech-savvy individuals and small businesses. Understanding the specific needs and preferences of its chosen target market is critical for developing effective marketing and sales strategies. Market research would be essential in identifying and refining this target market.

Contact Information and Accessibility

Rose Insurance in Salem prioritizes making its services readily available to the community. This includes a robust online presence, convenient physical location, and accessible customer service hours. Understanding how to connect with them and the ease of accessing their services is crucial for potential clients.

Connecting with Rose Insurance in Salem is straightforward, whether you prefer digital interaction or in-person assistance. Their commitment to accessibility extends beyond just providing contact details; it’s about ensuring a smooth and efficient experience for everyone.

Contact Details

Here’s how you can get in touch with Rose Insurance in Salem:

| Contact Method | Details |

|---|---|

| Address | [Insert Rose Insurance Salem’s Physical Address Here] |

| Phone Number | [Insert Rose Insurance Salem’s Phone Number Here] |

| Email Address | [Insert Rose Insurance Salem’s Email Address Here] |

| Website | [Insert Rose Insurance Salem’s Website Address Here] |

Accessibility of Services

Rose Insurance aims for broad accessibility. Their online presence, through their website and potentially social media channels, allows for 24/7 access to information about their services and policies. Their physical location in Salem provides a convenient option for in-person consultations and transactions during business hours. Customer service hours are designed to accommodate a wide range of schedules, with details available on their website or by contacting them directly.

For example, if a client prefers to handle everything online, they can easily obtain quotes, compare plans, and even submit claims through the website. Conversely, individuals who value face-to-face interactions can visit their Salem office during business hours for personalized assistance. The flexibility offered by both online and in-person options ensures that access is not limited by individual preferences or technological capabilities.

Rose Insurance Salem offers various coverage options, but figuring out the best fit for your needs can be tricky. Consider whether you primarily use your car for commuting or leisure; this significantly impacts your premiums, as highlighted in a Reddit discussion on commute or pleasure car insurance reddit. Ultimately, understanding your driving habits helps Rose Insurance Salem tailor the perfect policy for you.

Community Outreach Initiatives

Rose Insurance’s commitment to Salem extends beyond providing insurance services. They actively participate in community events and may offer specialized programs to enhance access to insurance for underserved populations. These initiatives could include workshops on financial literacy, partnerships with local organizations to reach specific demographics, or targeted advertising campaigns aimed at increasing awareness of insurance options.

For instance, they might sponsor a local community event or partner with a non-profit to offer discounted rates or educational resources to low-income families. These actions demonstrate a dedication to serving the Salem community holistically, ensuring that everyone has access to the insurance protection they need.

Illustrative Example: A Typical Claim Process: Rose Insurance Salem

Navigating an insurance claim can feel overwhelming, but understanding the process can ease anxieties. Rose Insurance Salem aims for a straightforward and supportive experience for its clients. Let’s walk through a typical claim scenario, highlighting the steps involved and the communication channels available.

Imagine Sarah, a Rose Insurance Salem customer, experiences a burst pipe in her kitchen, causing significant water damage. She needs to file a claim. This is where Rose Insurance’s clear process comes into play.

Claim Filing Procedure

The first step for Sarah is to report the incident as quickly as possible. This can be done via phone, online portal, or email. Rose Insurance Salem provides multiple contact options for immediate assistance. Once the incident is reported, a claim number is assigned, and Sarah receives confirmation.

Required Documentation

Next, Sarah needs to gather the necessary documentation to support her claim. This typically includes photos of the damage, receipts for any temporary repairs she made, and a detailed description of the event. For larger claims, additional documentation, such as contractor estimates, may be required. Rose Insurance Salem clearly Artikels the required documents on their website and during the initial claim report. This transparency helps expedite the process.

Claim Assessment and Investigation

Once Rose Insurance receives Sarah’s claim and supporting documentation, an adjuster will be assigned to assess the damage. This may involve an on-site inspection to evaluate the extent of the water damage. The adjuster will communicate with Sarah throughout the assessment process, providing updates and answering any questions she may have. This step typically takes a few business days, depending on the complexity of the claim.

Settlement and Payment

After the assessment, Rose Insurance Salem will determine the amount payable for Sarah’s claim, based on her policy coverage and the assessed damages. This decision will be communicated to Sarah in writing, along with an explanation of the payment process. Rose Insurance typically processes payments within a few business days of the claim settlement. Sarah can opt for direct deposit or a check, depending on her preference.

Communication Channels

Throughout the entire process, Sarah has multiple communication channels available to her. She can call the Rose Insurance Salem office directly, use the online customer portal to track her claim’s progress, or email the dedicated claims department. The availability of these channels ensures clear, timely communication and provides Sarah with peace of mind.

Final Wrap-Up

Source: co.id

So, is Rose Insurance Salem the right fit for you? After exploring their services, customer feedback, and market position, you’re now equipped to make a smart choice. Remember to weigh your needs against their offerings and don’t hesitate to reach out to them directly with any questions. Protecting your future shouldn’t be a gamble – do your homework, and choose wisely!